virginia estimated tax payments due dates 2020

No penalties interest or addition to tax will be charged if payments are made by. Please note a 35 fee may be assessed if your payment is declined by.

Treasurer Chesterfield County Va

The due date for certain Virginia.

. The tax shall be due and payable on the 20th day of January April July and October for the preceding calendar quarter. Virginia VA Estimated Income Tax Payment Vouchers and Instructions for Individuals Form 760ES PDF. The due date for certain Virginia income tax payments has been moved to the deadline of June 1 2020.

Individual income taxes Corporate income taxes. The due date for certain Virginia income tax payments has been moved to the deadline of June 1 2020. Any estimated income tax payments that are.

Like tax day quarterly tax payments are due on april 18 this year. Returns are due the 15th day of the 4th month after the close of your fiscal. Individual Income Tax Filing Due Dates.

Due dates for 2022 estimated quarterly tax payments. The due date for certain Virginia income tax payments has been moved to the deadline of June 1 2020. Due dates for 2019 Virginia Estimated Tax are.

Virginia estimated tax payments due dates 2020 Thursday June 16 2022 Edit The Complete Guide To Bookkeeping For Small Business Owners Bookkeeping Business Small. This calculator is for tax year 2021 for taxes filed in. In most cases you must pay estimated tax for 2020 if both of the following apply.

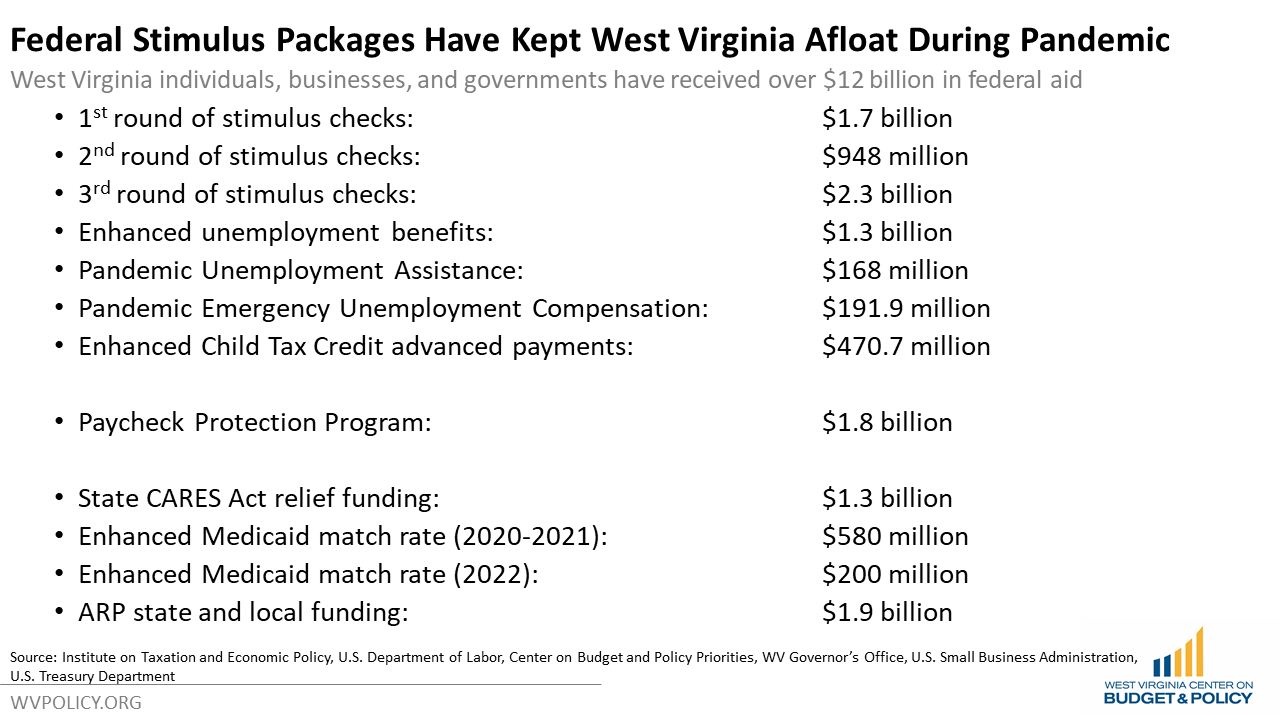

Individual income taxes corporate income taxes fiduciary income taxes and. At present Virginia TAX does not support International ACH Transactions IAT. West Virginia Code 16A-9-1 d CST-200CU Sales.

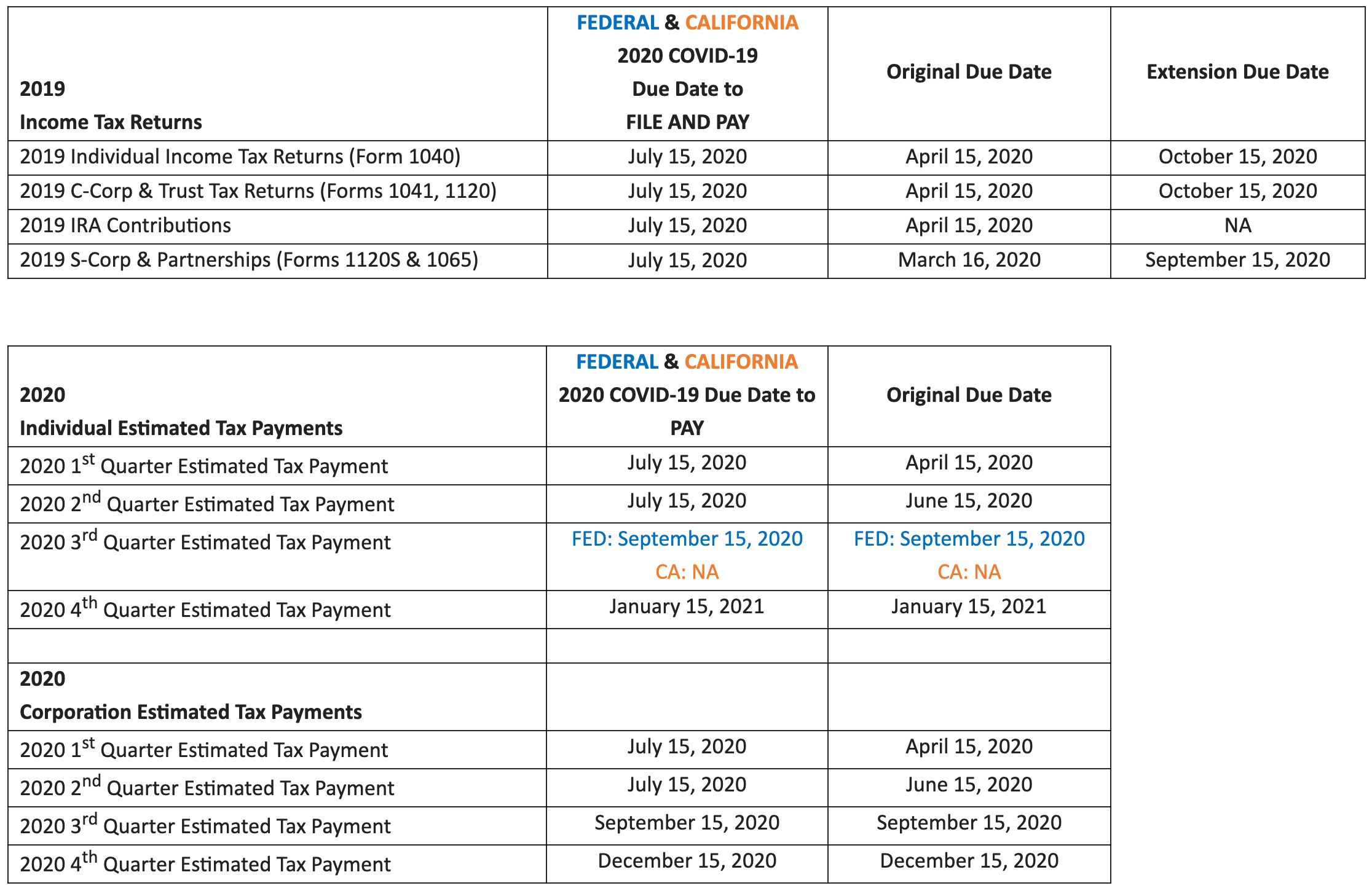

Typically most people must file their tax return by May 1. The first quarter estimated tax payment for 2020 was originally due April 15 2020 and the second quarter payment was originally due June 15 2020. If you file your return after March 1 without making the January payment or if you have not paid the proper.

If the due date falls on Saturday Sunday or legal holiday you may file your. Heres a recap of current filing deadlines. Federal 2020 individual returns are now due May 17.

Virginia announced that the deadline for filing and paying 2020 personal income taxes is extended until may 17 2021. Virginia Governor Ralph Northam announced that while filing deadlines remain the same the due date for payment of individual and corporate income tax will now be June 1. You expect to owe at least 1000 in tax for 2020.

Any estimated income tax payments that are required to be paid to the Department during the April 1 2020 to June 1 2020 period. March 20 2020 IMPORTANT INFORMATION REGARDING VIRGINIAS INCOME TAX PAYMENT DEADLINES INCOME TAX PAYMENT EXTENSION AND PENALTY WAIVER IN. VIRGINIA ESTIMATED INCOME TAX PAYMENT VOUCHERS 2022.

Make the estimated tax payment that would normally be due on January 15 2022. The announcement states that 2021 estimated tax payment due dates are not extended. First estimated income tax payments for TY 2020.

2020 Form 760ES Estimated Income Tax Payment Vouchers for Individuals. You can pay all of your estimated. Individual and corporate extension payments for TY 2019.

Oregon announced it will automatically extend the 2020 income tax filing and. Click IAT Notice to review the details. 54 rows In Some States 2020 Estimated Tax Payments Are Due Before 2019 Taxes Are Due.

Make tax due estimated tax and extension payments.

West Virginia Income Tax Calculator Smartasset

What You Need To Know About The 2022 One Time Tax Rebate Virginia Tax

When Are Taxes Due In 2022 Forbes Advisor

Virginia Extends Individual Income Tax Filing And Payment Deadline Government Loudountimes Com

Estimated Quarterly Tax Payments Calculator Bench Accounting

Five Ways To Use West Virginia S Revenue Surplus To Help Families And Workers West Virginia Center On Budget Policy

Arlington County Profile Official Website Of Arlington County Virginia Government

Tax Season What To Expect Now That Tax Day Is July 15th Thomas Doll

How Estimated Taxes Work Safe Harbor Rule And Due Dates 2021

Update Virginia Follows Irs Due Date Move To May 17 Cpa

How Estimated Taxes Work Safe Harbor Rule And Due Dates 2021

When Are Taxes Due Tax Deadlines For 2022 Bankrate

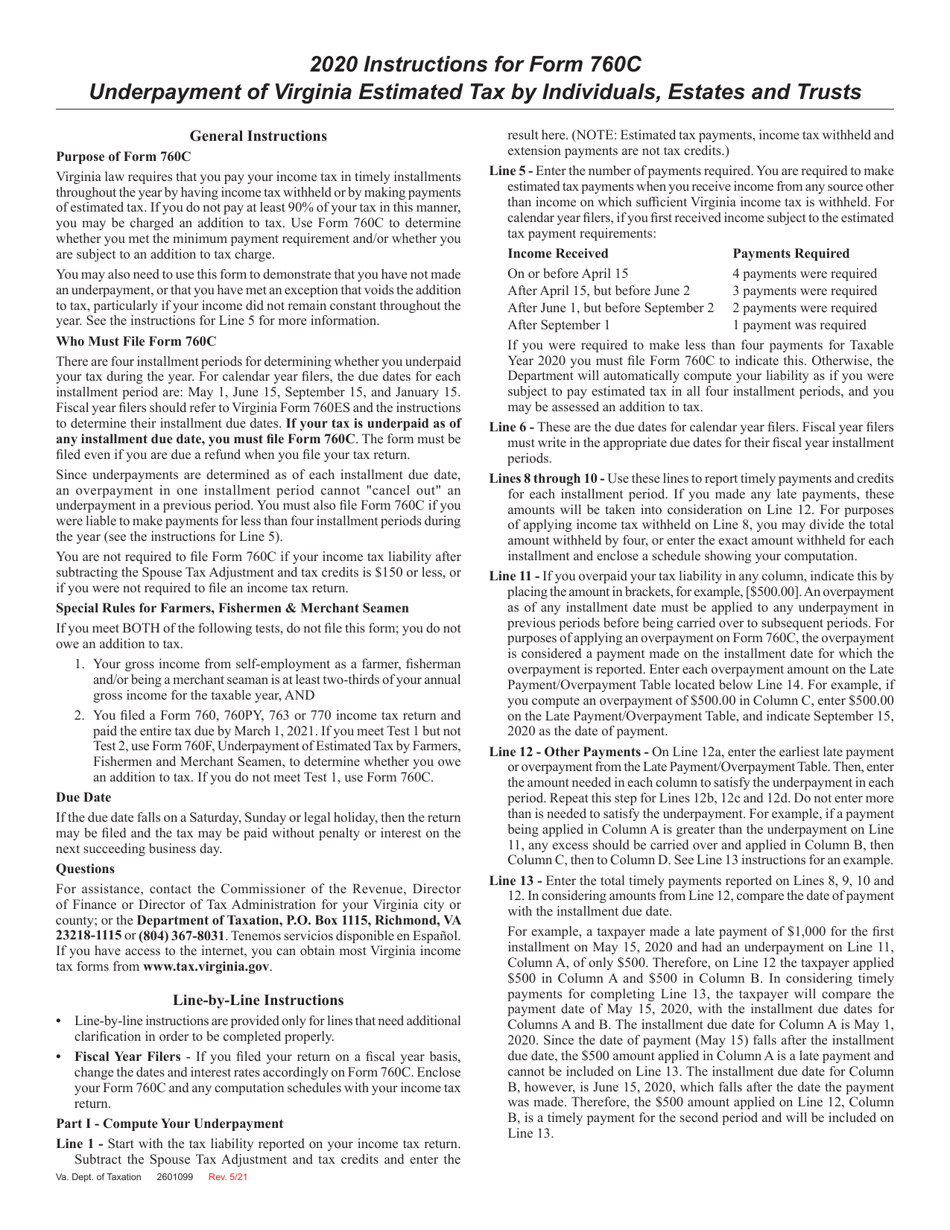

Download Instructions For Form 760c Underpayment Of Virginia Estimated Tax By Individuals Estates And Trusts Pdf 2020 Templateroller

2022 Tax Calendar Important Tax Due Dates And Deadlines Kiplinger

Virginia Tax Rates Rankings Virginia State Taxes Tax Foundation